Are you dreaming of owning your own home? Purchasing a house is a significant milestone in many people's lives, but it often comes with a hefty price tag.

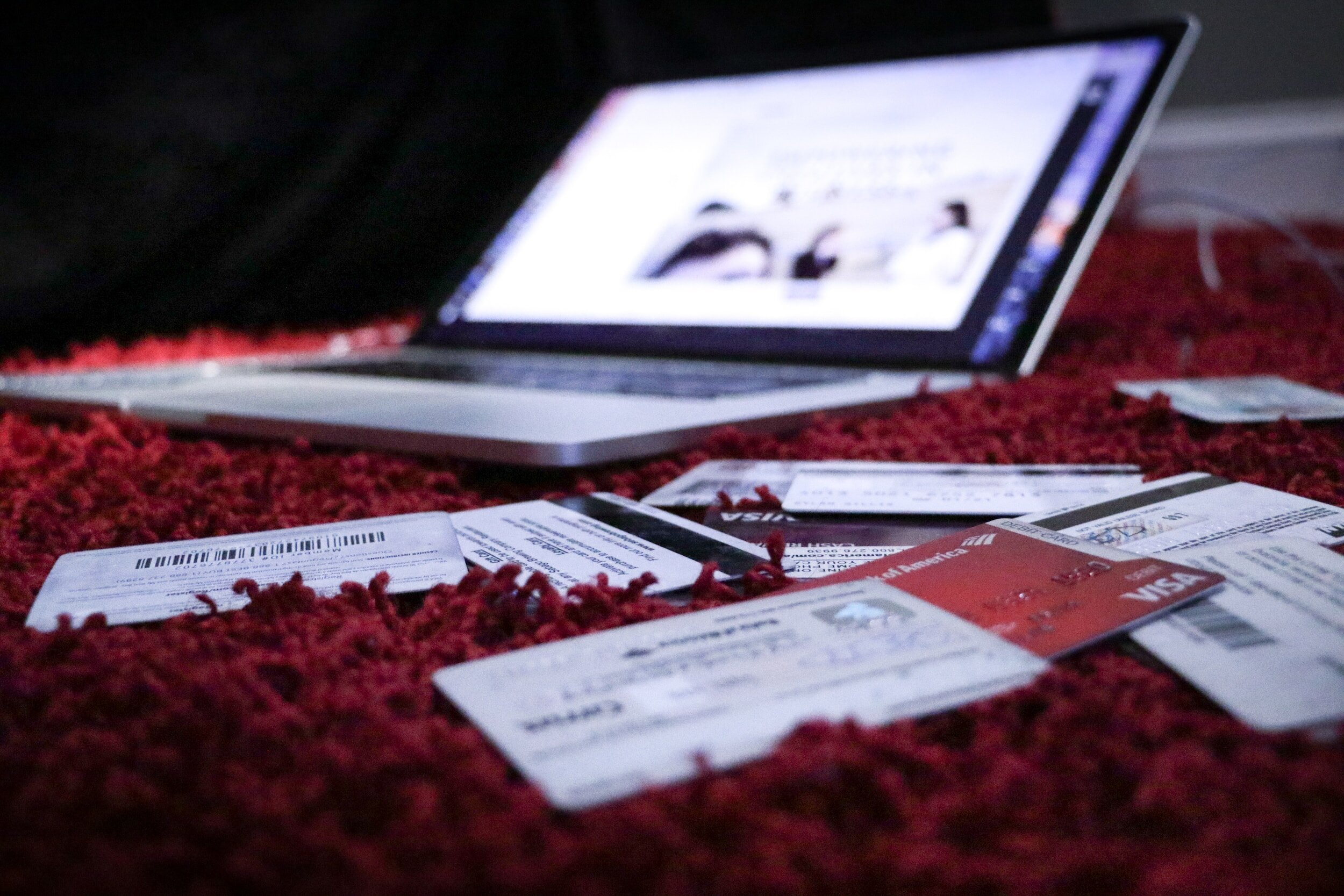

To secure a favorable mortgage rate and make your dream a reality, it's essential to have a strong credit score.

Here are several credit-building tips to help you qualify for the best mortgage rates possible:

Check Your Credit Report: Start by obtaining a free copy of your credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion. Review them carefully for errors or discrepancies that could be negatively impacting your score. Dispute any inaccuracies to ensure your credit profile is as accurate as possible.

Pay Bills on Time: Your payment history has a significant impact on your credit score. Make sure to pay all of your bills, including credit cards, loans, and utilities, on time. Set up reminders or automatic payments to avoid late payments.

Reduce Credit Card Balances: High credit card balances relative to your credit limit can harm your credit score. Aim to keep your credit card utilization below 30%. Pay down balances as much as possible to demonstrate responsible credit management.

Avoid Opening New Credit Accounts: Each time you apply for a new credit card or loan, it can result in a hard inquiry on your credit report, which can temporarily lower your score. Limit new credit inquiries while you're preparing to buy a home.

Diversify Your Credit Mix: Having a mix of different types of credit, such as credit cards, installment loans, and retail accounts, can positively impact your credit score. However, don't open new accounts just for the sake of diversity—only do so if it makes financial sense.

Maintain Old Credit Accounts: The length of your credit history matters. Keep older, well-managed credit accounts open to demonstrate a longer credit history, which can improve your credit score.

Use Credit Responsibly: Responsible credit use means not maxing out your credit cards, avoiding cash advances, and only borrowing what you can comfortably afford to repay.

Seek Professional Guidance: If you're struggling to improve your credit, consider consulting a credit counselor or financial advisor. They can provide personalized advice and strategies to boost your score.

Building and maintaining good credit takes time and discipline, but the payoff is worth it when you secure a favorable mortgage rate. By following these credit-building tips, you'll be one step closer to turning your homeownership dream into a reality.

Remember, the stronger your credit score, the more negotiating power you have when it comes to your mortgage terms.

--

--